A living tool

Start with the real journey - not a template 👋

Mapping workflows - every form, every hand-off, and every decision point. Hidden pressure points and unspoken bottlenecks: is it KYC? risk flags? decision delay?

A living tool - one everyone understands and uses daily.

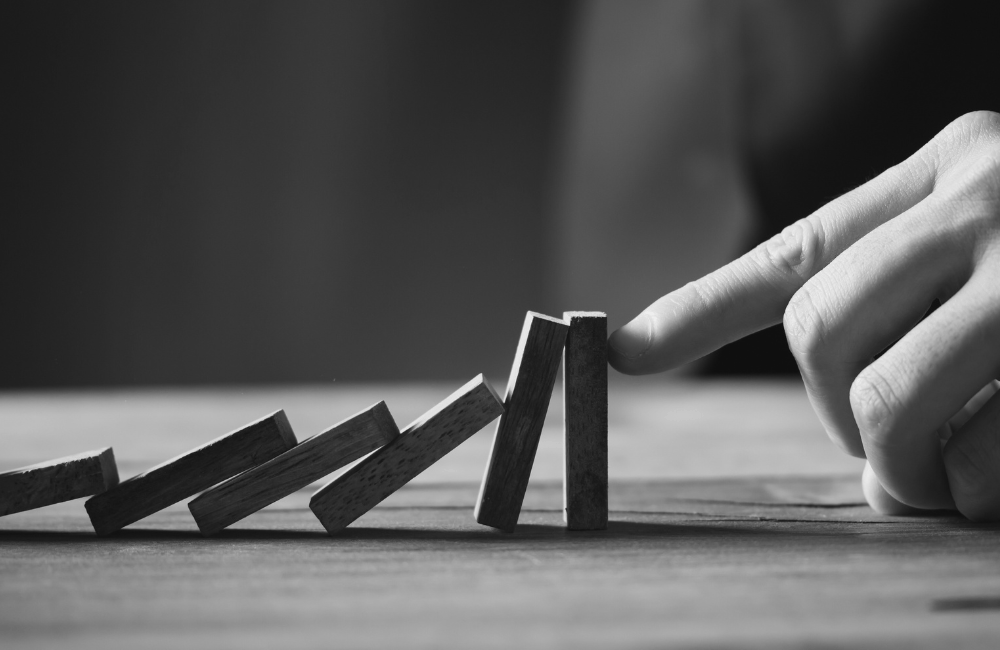

Get early wins

Spot the gaps and prioritise

Quick wins that reduce friction - eg. automating a manual KYC step or adding smart form validation. Phased improvements - you get both fast impact and future-proof design, tailored to your roadmap.

Align every fix with risk reduction or revenue gain.

Build a shared vision

Compliance lives or dies on understanding

Stakeholder workshops - C-level, team leads, and staff, so everyone’s voice shapes the process.

Deliver a usable playbook - how compliance touches product, operations, support, and leadership.

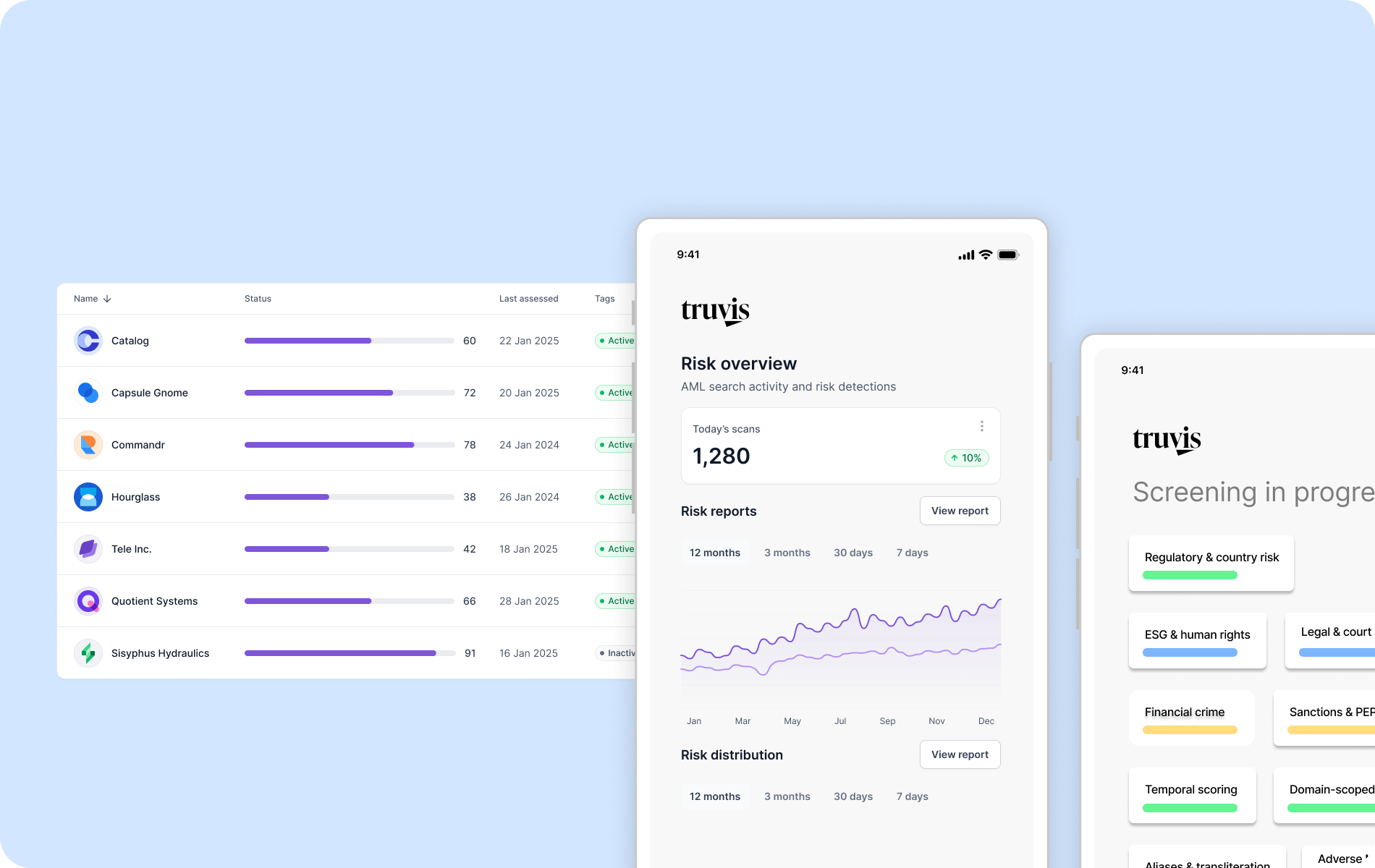

Automation that feels human

Remove busywork, not human judgement

Build workflows, alert triggers, and onboarding flows that make sense to clients and your team.

Automate - report, notify, and escalate without spamming inboxes.

Real workflows mapped

Ongoing coaching & performance support

Monthly or quarterly health check-ins, audit prep, and automation tune-ups. Help adjust for new regulation, business changes, or changing client risk profiles.

Don’t let automation drift - we help you fine-tune what matters, when it matters.