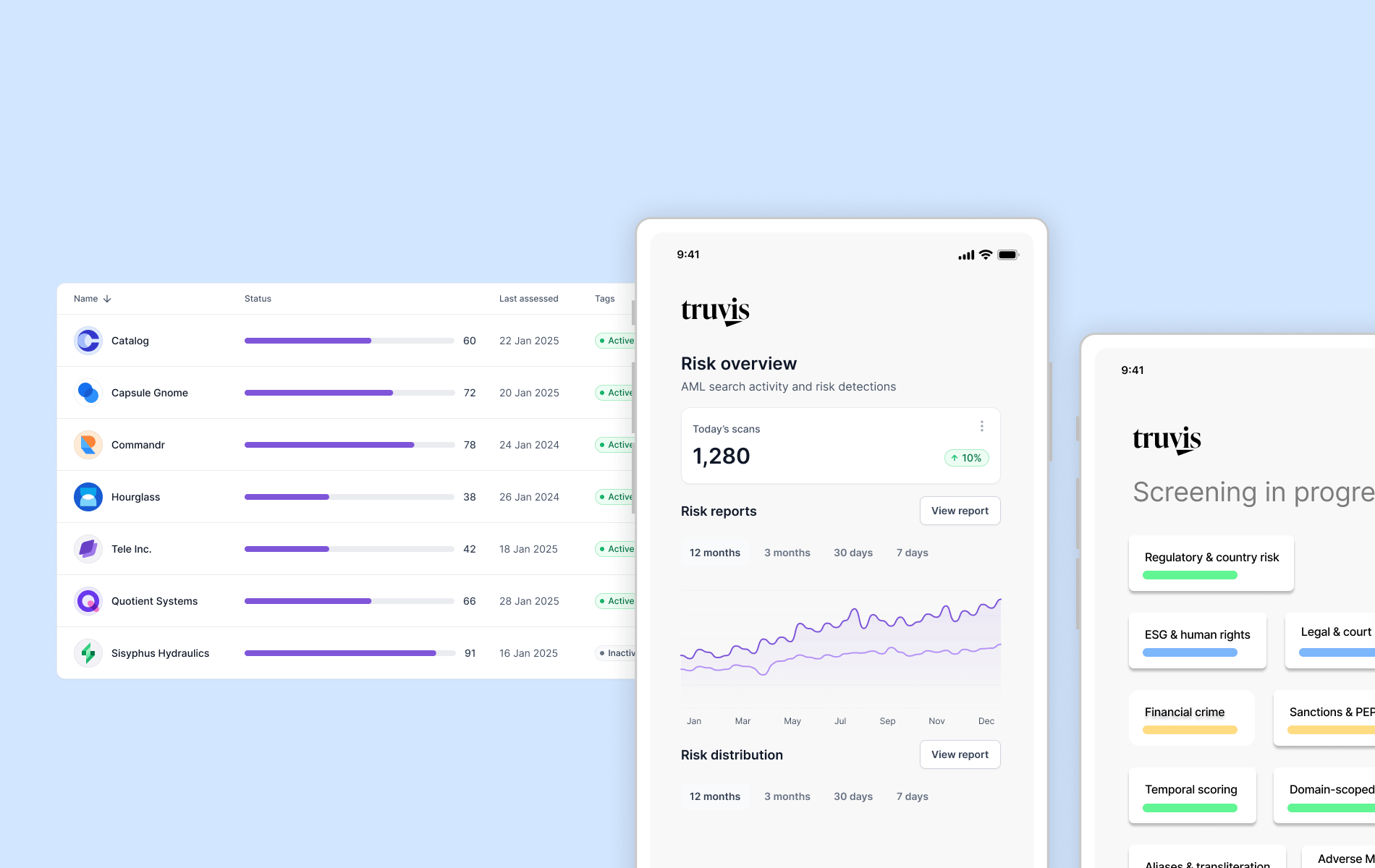

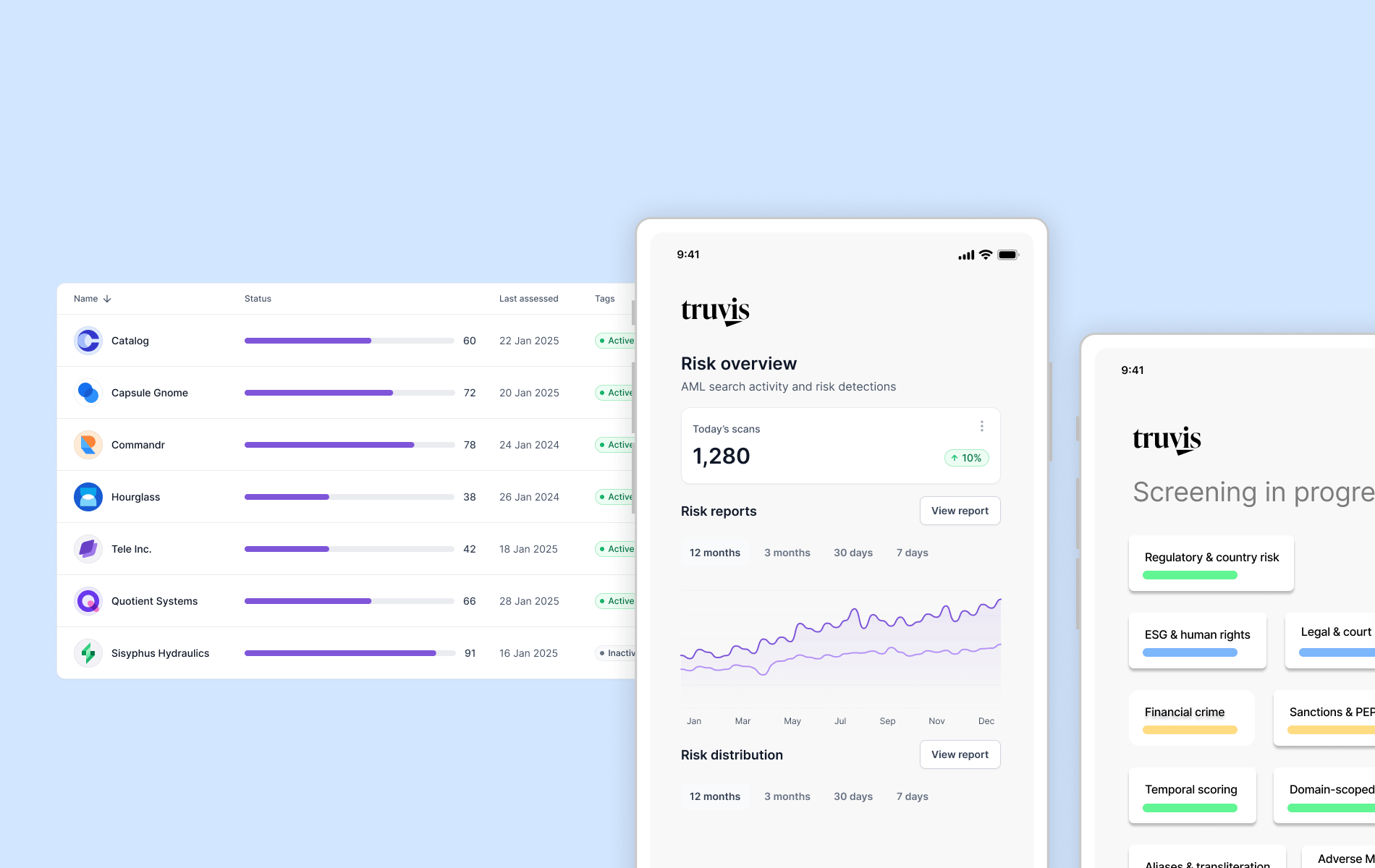

Truvis AML Checker

Spot risk early, act faster

Get instant visibility into potential financial crime, reputational, and regulatory risks backed by multi-signal risk intelligence

Truvis AML Checker

Get instant visibility into potential financial crime, reputational, and regulatory risks backed by multi-signal risk intelligence

AI-powered engine runs structured open-source searches across regulatory, legal, environmental, and reputational domains - returning clear, explainable risk bands.

1

Fraud, corruption, embezzlement, or criminal activity in public sources

2

Lawsuits, convictions, or tribunal outcomes

3

Mentions linked to UN, EU, OFAC, OFSI, or politically exposed persons

4

Insider trading, shell companies, tax evasion, market manipulation

5

FATF, FinCEN, FATCA, OSCE, or high-risk jurisdiction listings

6

Environmental crimes, forced labour, trafficking, modern slavery

7

Leaked data, whistleblower posts, or scam reports

8

Trusted outlets like Reuters, Bloomberg, SEC, and justice.gov

9

Name variations and local language equivalents

10

How recent and credible each mention is

No storage by default, your searches are not saved or logged • Transparent scoring with every risk flag links to its public source

Most AML tools rely only on static lists.

Real risk hides in the open web - in news, regulatory releases, and court archives.

Our Ai engine merges both worlds: official sources + open intelligence, giving a fuller picture of exposure.

From fintechs to law firms, organisations are under rising pressure to prove they truly understand who they’re dealing with. Manual AML checks are slow, inconsistent, and miss early risk signals that could save millions.

Uncover hidden exposure across sanctions, financial crime, ESG breaches, and reputational leaks, all in seconds, with full traceability.

As regulations tighten across the UK, EU, and U.S., demand for fast, explainable due-diligence tools is accelerating.

of teams say manual AML screening is the biggest operational bottleneck -

Thomson Reuters Risk Survey 2024

Global RegTech market growth projected in 2025 - Deloitte RegTech Outlook

of institutions plan to adopt AI or automation in their AML workflows within 2 years - FATF compliance Report

“We used to spend hours cross-checking names manually across sanction lists and public databases. The Parrot AML Checker flags exposure across multiple jurisdictions instantly, and the accuracy has been impressive even for complex entities.”

Cut error-prone admin, reduce regulatory risk,

and reclaim hours every week.

62%

82%

65%